What Is The Property Tax Rate In Cleveland Ohio . Web based on 2023 property tax rates being used for the bills due in 2024, properties in the shaker square area of. The highest rates are in. Your actual property tax may be more or less than the value calculated in the estimator. The treasurer's office wants to. However, tax rates vary significantly between ohio counties and cities. Web property taxes are calculated based on the value of your property and the tax rate within your community. Web mobile home taxes are billed twice a year, as well, with payment due march 1st and july 31st. Web the average effective property tax rate in ohio is 1.41%. Web an explanation of cuyahoga county property tax rates. The total rate approved by the voters in your taxing.

from www.chandleraz.gov

Your actual property tax may be more or less than the value calculated in the estimator. However, tax rates vary significantly between ohio counties and cities. The highest rates are in. The treasurer's office wants to. The total rate approved by the voters in your taxing. Web mobile home taxes are billed twice a year, as well, with payment due march 1st and july 31st. Web based on 2023 property tax rates being used for the bills due in 2024, properties in the shaker square area of. Web property taxes are calculated based on the value of your property and the tax rate within your community. Web an explanation of cuyahoga county property tax rates. Web the average effective property tax rate in ohio is 1.41%.

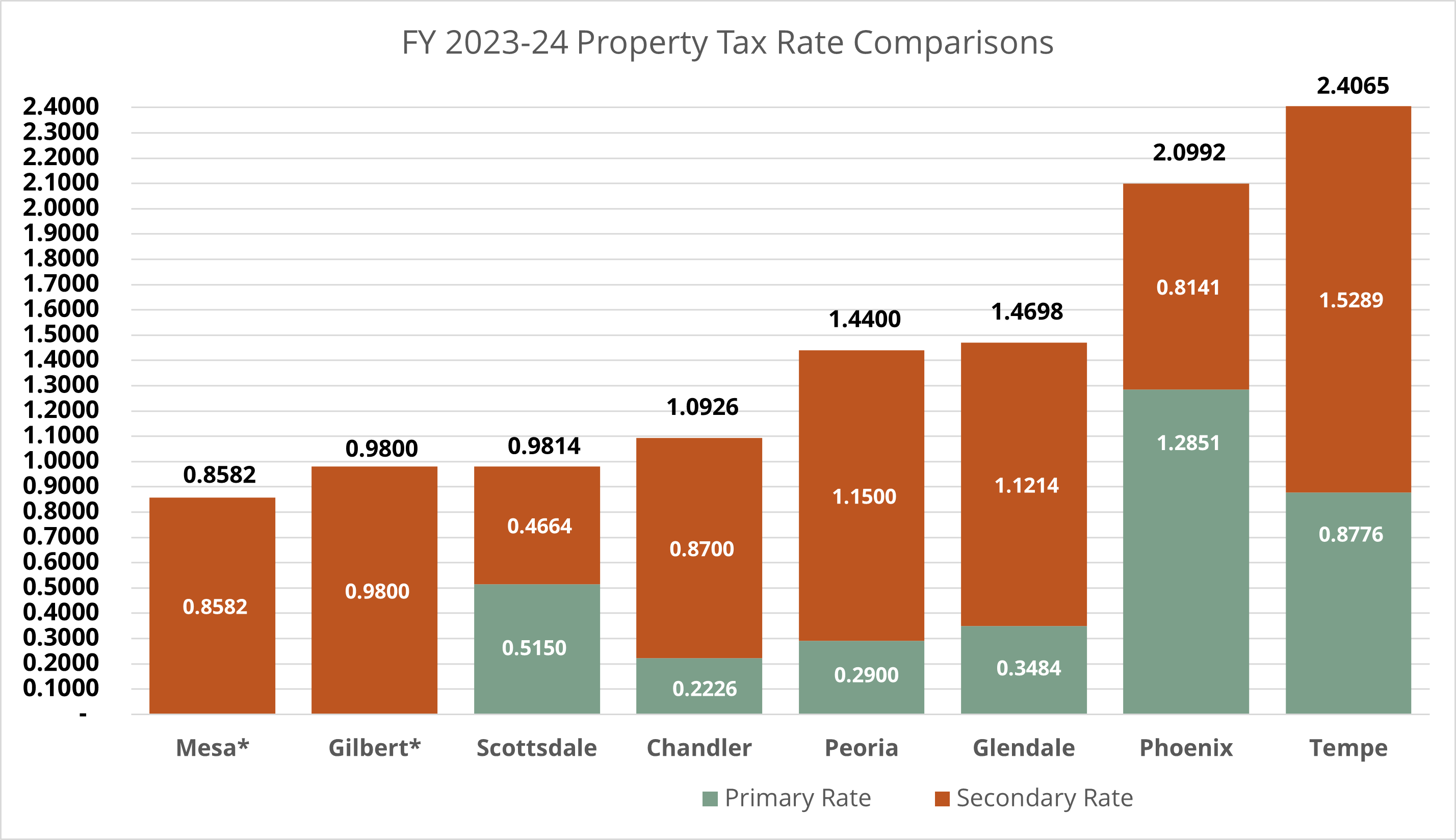

Property Tax Reports, Rates, and Comparisons City of Chandler

What Is The Property Tax Rate In Cleveland Ohio Web the average effective property tax rate in ohio is 1.41%. However, tax rates vary significantly between ohio counties and cities. Web property taxes are calculated based on the value of your property and the tax rate within your community. The treasurer's office wants to. The highest rates are in. Web mobile home taxes are billed twice a year, as well, with payment due march 1st and july 31st. Web the average effective property tax rate in ohio is 1.41%. Web an explanation of cuyahoga county property tax rates. Web based on 2023 property tax rates being used for the bills due in 2024, properties in the shaker square area of. Your actual property tax may be more or less than the value calculated in the estimator. The total rate approved by the voters in your taxing.

From www.cleveland.com

Compare new property tax rates in Greater Cleveland, Akron; Garfield What Is The Property Tax Rate In Cleveland Ohio The highest rates are in. Web property taxes are calculated based on the value of your property and the tax rate within your community. Web mobile home taxes are billed twice a year, as well, with payment due march 1st and july 31st. The total rate approved by the voters in your taxing. However, tax rates vary significantly between ohio. What Is The Property Tax Rate In Cleveland Ohio.

From amkamamaroo.blogspot.com

Property Tax Calculator Ohio What Is The Property Tax Rate In Cleveland Ohio The highest rates are in. Web an explanation of cuyahoga county property tax rates. Your actual property tax may be more or less than the value calculated in the estimator. Web based on 2023 property tax rates being used for the bills due in 2024, properties in the shaker square area of. However, tax rates vary significantly between ohio counties. What Is The Property Tax Rate In Cleveland Ohio.

From www.cleveland.com

Property tax rates increase across Northeast Ohio What Is The Property Tax Rate In Cleveland Ohio Your actual property tax may be more or less than the value calculated in the estimator. Web property taxes are calculated based on the value of your property and the tax rate within your community. Web the average effective property tax rate in ohio is 1.41%. Web mobile home taxes are billed twice a year, as well, with payment due. What Is The Property Tax Rate In Cleveland Ohio.

From www.cleveland.com

Ohio ranks 22nd highest for property tax bills; 9th for property tax What Is The Property Tax Rate In Cleveland Ohio Web the average effective property tax rate in ohio is 1.41%. However, tax rates vary significantly between ohio counties and cities. The total rate approved by the voters in your taxing. Web mobile home taxes are billed twice a year, as well, with payment due march 1st and july 31st. Web property taxes are calculated based on the value of. What Is The Property Tax Rate In Cleveland Ohio.

From www.cleveland.com

What you should know as Ohio considers increasing the gas tax; what you What Is The Property Tax Rate In Cleveland Ohio The treasurer's office wants to. Web an explanation of cuyahoga county property tax rates. Your actual property tax may be more or less than the value calculated in the estimator. Web property taxes are calculated based on the value of your property and the tax rate within your community. Web mobile home taxes are billed twice a year, as well,. What Is The Property Tax Rate In Cleveland Ohio.

From www.fox21online.com

Duluth's Council Approves 8.9 Increase In Property Tax Levy What Is The Property Tax Rate In Cleveland Ohio Web mobile home taxes are billed twice a year, as well, with payment due march 1st and july 31st. However, tax rates vary significantly between ohio counties and cities. Web property taxes are calculated based on the value of your property and the tax rate within your community. The total rate approved by the voters in your taxing. Web an. What Is The Property Tax Rate In Cleveland Ohio.

From www.cashreview.com

State Corporate Tax Rates and Brackets for 2023 CashReview What Is The Property Tax Rate In Cleveland Ohio Web an explanation of cuyahoga county property tax rates. Web based on 2023 property tax rates being used for the bills due in 2024, properties in the shaker square area of. However, tax rates vary significantly between ohio counties and cities. The treasurer's office wants to. Web mobile home taxes are billed twice a year, as well, with payment due. What Is The Property Tax Rate In Cleveland Ohio.

From www.primecorporateservices.com

Comparing Property Tax Rates State By State Prime Corporate Services What Is The Property Tax Rate In Cleveland Ohio The treasurer's office wants to. Your actual property tax may be more or less than the value calculated in the estimator. Web an explanation of cuyahoga county property tax rates. Web mobile home taxes are billed twice a year, as well, with payment due march 1st and july 31st. The total rate approved by the voters in your taxing. The. What Is The Property Tax Rate In Cleveland Ohio.

From www.cleveland.com

What would Gov. John Kasich's proposed sales tax increase cost you? How What Is The Property Tax Rate In Cleveland Ohio However, tax rates vary significantly between ohio counties and cities. Web the average effective property tax rate in ohio is 1.41%. The treasurer's office wants to. The highest rates are in. Web property taxes are calculated based on the value of your property and the tax rate within your community. Web mobile home taxes are billed twice a year, as. What Is The Property Tax Rate In Cleveland Ohio.

From lannaqdeloris.pages.dev

When Are Ohio Property Taxes Due 2024 Avie Melina What Is The Property Tax Rate In Cleveland Ohio Web property taxes are calculated based on the value of your property and the tax rate within your community. Web based on 2023 property tax rates being used for the bills due in 2024, properties in the shaker square area of. The total rate approved by the voters in your taxing. Your actual property tax may be more or less. What Is The Property Tax Rate In Cleveland Ohio.

From www.cleveland.com

Northeast Ohio property tax rates, typical and highest tax bills in What Is The Property Tax Rate In Cleveland Ohio Web based on 2023 property tax rates being used for the bills due in 2024, properties in the shaker square area of. However, tax rates vary significantly between ohio counties and cities. Your actual property tax may be more or less than the value calculated in the estimator. Web property taxes are calculated based on the value of your property. What Is The Property Tax Rate In Cleveland Ohio.

From www.youtube.com

How can I lower my property taxes in Ohio? YouTube What Is The Property Tax Rate In Cleveland Ohio Web an explanation of cuyahoga county property tax rates. However, tax rates vary significantly between ohio counties and cities. The treasurer's office wants to. Web based on 2023 property tax rates being used for the bills due in 2024, properties in the shaker square area of. Web mobile home taxes are billed twice a year, as well, with payment due. What Is The Property Tax Rate In Cleveland Ohio.

From www.cleveland.com

Compare Greater Cleveland, Akron property tax rates, and learn why they What Is The Property Tax Rate In Cleveland Ohio Web the average effective property tax rate in ohio is 1.41%. Web mobile home taxes are billed twice a year, as well, with payment due march 1st and july 31st. Web an explanation of cuyahoga county property tax rates. Your actual property tax may be more or less than the value calculated in the estimator. However, tax rates vary significantly. What Is The Property Tax Rate In Cleveland Ohio.

From www.cleveland.com

Greater Cleveland’s wide spread in property tax rates see where your What Is The Property Tax Rate In Cleveland Ohio The total rate approved by the voters in your taxing. Web the average effective property tax rate in ohio is 1.41%. Web property taxes are calculated based on the value of your property and the tax rate within your community. Web based on 2023 property tax rates being used for the bills due in 2024, properties in the shaker square. What Is The Property Tax Rate In Cleveland Ohio.

From www.cleveland.com

Property tax bite ranking Cuyahoga County towns for bills on typical What Is The Property Tax Rate In Cleveland Ohio The total rate approved by the voters in your taxing. The highest rates are in. Web based on 2023 property tax rates being used for the bills due in 2024, properties in the shaker square area of. Web the average effective property tax rate in ohio is 1.41%. Your actual property tax may be more or less than the value. What Is The Property Tax Rate In Cleveland Ohio.

From www.cleveland.com

After sweeping municipal tax rate increases across Ohio, where What Is The Property Tax Rate In Cleveland Ohio Web an explanation of cuyahoga county property tax rates. Your actual property tax may be more or less than the value calculated in the estimator. The total rate approved by the voters in your taxing. Web property taxes are calculated based on the value of your property and the tax rate within your community. Web the average effective property tax. What Is The Property Tax Rate In Cleveland Ohio.

From www.cleveland.com

Compare new property tax rates in Greater Cleveland, Akron; part of What Is The Property Tax Rate In Cleveland Ohio Web based on 2023 property tax rates being used for the bills due in 2024, properties in the shaker square area of. Web the average effective property tax rate in ohio is 1.41%. The treasurer's office wants to. The highest rates are in. Your actual property tax may be more or less than the value calculated in the estimator. Web. What Is The Property Tax Rate In Cleveland Ohio.

From www.cleveland.com

Cuyahoga County property taxes due Thursday; other counties in February What Is The Property Tax Rate In Cleveland Ohio The total rate approved by the voters in your taxing. However, tax rates vary significantly between ohio counties and cities. Your actual property tax may be more or less than the value calculated in the estimator. Web property taxes are calculated based on the value of your property and the tax rate within your community. Web an explanation of cuyahoga. What Is The Property Tax Rate In Cleveland Ohio.